Today’s posts that caught my eye:

I didn’t think I would find the stories on the international travel ban ending and borders opening as moving as I did… until I saw the videos.

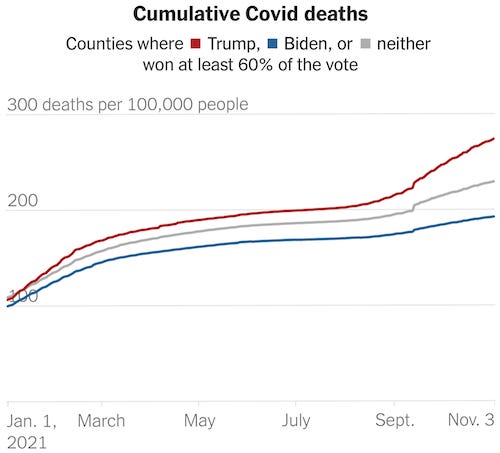

The gap in Covid’s death toll between red and blue America has grown faster over the past month than at any previous point, the NYT reports.

The S&P 500 completed its longest streak of all-time closing highs since 1997.

Subscribers support the creation of the newsletter, podcasts & live events.

The World

From Dublin, Sao Paolo, Brussels, London and other cities around the world, international visitors spilled into U.S. airports in joyous celebrations that marked the end of a pandemic-related travel ban that kept them separated from loved ones for more than 18 months. “On behalf of the U.S. travel industry: WELCOME,” the U.S. Travel Association said in a tweet. The end of a 33-nation ban that kept most non-U.S. citizens out of the country took on a celebratory air, throwing a lifeline to an industry seeking to rebound from the pandemic — and sparking reunions at international airports across the country. (Washington Post)

The Federal Reserve warned that stresses in the Chinese real estate sector “posed some risk to the US financial system”, pointing to heavily indebted property companies like Evergrande as a potential source of global contagion. “Given the size of China’s economy and financial system as well as its extensive trade linkages with the rest of the world, financial stresses in China could strain global financial markets through a deterioration of risk sentiment, pose risks to global economic growth, and affect the United States,” the Fed warned in its semi-annual Financial Stability Report. On the domestic front, the Fed also warned that a “steep rise” in interest rates could lead to a “large” correction in risky assets, in addition to a reduction in housing demand that in turn could lead to lower home prices. Employment and investments could take a hit too as borrowing costs for business rose. (Financial Times)

Plastic waste from the Covid-19 pandemic weighing 25,900 tonnes, equivalent to more than 2,000 double decker buses, has leaked into the ocean, research has revealed. The mismanaged plastic waste, consisting of personal protective equipment such as masks and gloves, vastly exceeded the capability of countries to process it properly. (The Guardian)

The gap in Covid’s death toll between red and blue America has grown faster over the past month than at any previous point. In October, 25 out of every 100,000 residents of heavily Trump counties died from Covid, more than three times higher than the rate in heavily Biden counties (7.8 per 100,000). October was the fifth consecutive month that the percentage gap between the death rates in Trump counties and Biden counties widened. (New York Times)

Japan recorded no daily deaths from COVID-19 for the first time in more than a year on Sunday. Prior to Sunday, there had not been a day without a COVID-19 death since Aug. 2, 2020. (Reuters)

Boeing vaccine backlash builds as 11,000 workers seek exemption. Nearly 9% of the company’s U.S. workforce are balking. (Bloomberg)

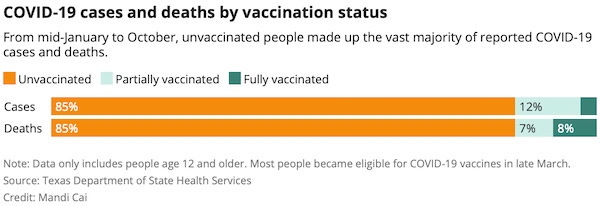

Unvaccinated Texans make up vast majority of COVID-19 cases and deaths this year. Out of nearly 29,000 Texans who have died from COVID-related illnesses since mid-January, only 8% of them were fully vaccinated against the virus, according to a report detailing the Texas Department of State Health Services’ findings. (Texas Tribune)

McDonald’s CEO Chris Kempczinski is apologizing for a text about the shooting deaths of two Chicago children. Kempczinski planned to address U.S. employees regarding comments that “were wrong—plain and simple,” he wrote in an email to staff Friday. “I am learning from this,” said Mr. Kempczinski in the message. In an exchange with Chicago Mayor Lori Lightfoot this past April, Mr. Kempczinski referenced the shooting deaths of two city children. Mr. Kempczinski in the text to Ms. Lightfoot called the shootings “tragic.” He then wrote: “With both, the parents failed those kids which I know is something you can’t say. Even harder to fix.” (Wall Street Journal)

State Farm aired far fewer commercials that featured Aaron Rodgers over the weekend after the NFL star recently divulged he was unvaccinated against Covid-19 and questioned vaccine effectiveness. About 1.5% of the nearly 400 State Farm television advertisements aired on Sunday through 8 p.m. ET included Rodgers, compared with more than 20% the two Sundays prior. State Farm ads featuring Rodgers also declined on Saturday, with Rodgers appearing in less than 2% of ads compared with 13% and 15%, respectively, the two previous Saturdays. (Wall Street Journal)

TX Gov. Greg Abbott told state agencies to develop standards to block books with "overtly sexual" content in schools. Abbott targeted two books that have been removed by schools recently that center on LGBTQ characters. One of the books includes a graphic illustration and the other includes depictions of sex. (Texas Tribune)

Minority teens are more likely than White teens to say graduating from college is important: Nearly 9 in 10 minority teens ages 14 to 18 said graduating from college is “very” or “fairly” important, compared with 75 percent of their White peers, according to a Washington Post-Ipsos poll. In all, 92 percent of Black and Asian teens along with 88 percent of Hispanic teens said that graduating from college was important. The poll found that a 58 percent majority of teens said getting a four-year college degree was worth the cost, including 73 percent of Asian teens, 63 percent of Hispanic teens, 59 percent of Black teens and 55 percent of White teens. (Washington Post)

Economy

The S&P 500 completed its longest streak of all-time closing highs since 1997, with market sentiment buoyed by strong corporate earnings and big central banks affirming their easy monetary policies. The blue-chip index inched up 0.1%, enough to mark an eighth straight record close. The technology-focused Nasdaq Composite also closed 0.1% higher. (Financial Times)

Bitcoin and ether made record peaks in Asia trade, with enthusiasm for cryptocurrency adoption and worry about inflation driving momentum and flows into the asset class. Bitcoin rose as high as $68,564 in Asian afternoon trade and ether , the second-biggest cryptocurrency by market value, earlier hit $4,825. (Reuters)

Wall Street banks are making a big push to help private companies in Europe raise cash in order to beat local rivals and increase their chances of securing lucrative mandates for a fresh wave of blockbuster public offerings. Senior executives at Goldman Sachs and JPMorgan Chase said they were focusing expansion efforts on their private placements businesses amid a broader feeding frenzy in capital markets. They are betting that the increase in fundraisings by private companies will prove to be more than a temporary boom. (Financial Times)

Germany’s export-oriented economy used to be a reliable engine for pulling Europe out of slumps. Now, as the continent emerges from a pandemic torpor, Germany is lagging behind. German manufacturers are struggling to produce cars and factory equipment because of parts and labor shortages. They face surging energy prices that are making sky-high electricity bills even higher. And they must invest hundreds of billions of dollars over coming years to meet new clean-energy standards. (Wall Street Journal)

Nextdoor, the neighborhood social networking firm, got a neighborly welcome from Wall Street on its first day as a public company on Monday. Nextdoor shares closed up 17%, a decent showing for the company, which completed a merger with a special purpose acquisition company last week. The performance was a contrast to two big-name tech firms that recently went public via SPAC mergers: WeWork and Bird. WeWork shares have fallen 27% since its merger, while Bird shares have fallen 21% since its SPAC merger was approved last week. (The Information)

Technology

Here's what's in the $1 trillion infrastructure bill for tech: The bill allocates a total of $65 billion for broadband. That includes $42.45 billion in grants to states, which can be used for actual broadband deployment, as well as data collection and employee training, among other things. Under that $65 billion is $14.2 billion to provide $30 monthly discounts to low-income Americans, as well as $2.75 billion in grants for digital literacy programs, and $2 billion for rural broadband construction. There's also $7.5 billion for electric vehicle charging stations, and $5 billion for electric and hybrid school buses. (Protocol)

Robinhood said that an intruder gained access to its systems last week and made off with the personal information of millions of its users. Email addresses for about five million Robinhood users were exposed, as were the full names of a different group of about two million users. The intruder also accessed more-extensive personal information for a subset of more than 300 users. (Wall Street Journal)

Advanced Micro Devices said it has won Meta Platforms (formerly Facebook) as a data center chip customer, sending AMD shares up more than 11% as it cemented some of its gains against Intel. It also announced a range of new chips aimed at taking on larger rivals such as Nvidia in supercomputing markets, as well as smaller competitors, including Ampere Computing in the cloud computing market. (Reuters)

The M1 Macs are the new software engineer status symbol. (Protocol)

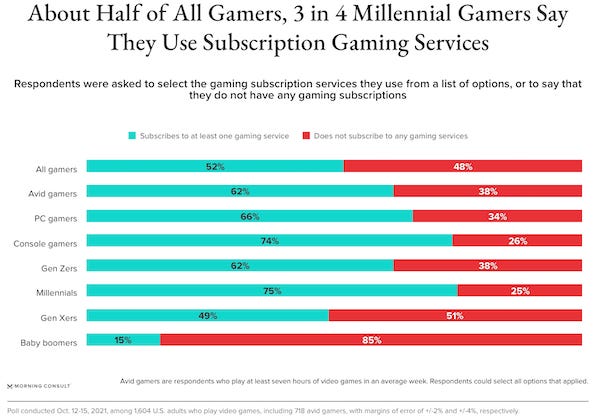

The subscription economy has officially infiltrated gaming: Half of the gaming market, including a strong majority of millennial gamers, say they pay for at least one service as industry shifts toward subscriptions. (Morning Consult)

Smart Links

Investors take aim at private equity’s use of private jets. (Financial Times)

Foreign visitors are flocking to these five U.S. cities. (Bloomberg)

Buy ‘record cheap’ British stocks now, says JP Morgan. (The Times)

Macy’s raises hourly wage to $15 and rolls out college tuition to try to win workers. (CNBC)

Stay-at-home stocks are imploding as the world reopens. (Axios)

Self-driving cars, fusion energy land huge bets. (Crunchbase)

Live Nation stock tumbles — losing more than $1bn in market value — on lawsuits over deadly Astroworld festival. (Financial Times)

NFT games are fun. Filing taxes afterward is a nightmare. (Protocol)

NYC gets own cryptocurrency after mayor-elect Adams touts bitcoin. (Bloomberg)

Earth’s first continents emerged from the ocean 700m years earlier than thought. (The Guardian)

Good News

How this Minnesota woman went from homeless in Rochester to an Ivy League degree. (Minneapolis Star Tribune)

A 148-year-old Georgia weekly was about to close so its publisher could retire, but UGA's journalism school is taking it over and making it a capstone class. (Poynter)

Subscribers support the creation of the newsletter, podcasts & live events.