Two asks if you like this newsletter:

Please forward it! Sending this to 5 people you think would like it is the best way to help me get the word out. Thank you.

Please sign up for a paid subscription. Don’t forget: During this two-week trial, you get the Founding Member Rate — 50% off the regular cost. Continued thanks to everyone who already has done so!

Reminder: Register here for my live online event, this Thursday, April 23 @ 7:30 pm ET: Front Row at the Trump Show: A Conversation with ABC News’ Jonathan Karl.

Now to today’s briefing…

The World

Details emerge around Congress’ pending $470 billion deal to renew funding for a small-business loan program. The Senate plans to hold a brief session this afternoon, during which the Republican and Democratic leaders could pass the deal if no single senator objects. The House is slated to hold a similar brief session Tuesday, though House minority leader Kevin McCarthy accused Democrats of holding up a deal.(Washington Post, Los Angeles Times, Reuters):

About $310 billion to the Paycheck Protection Program for small businesses, plus $60 billion to a separate emergency loan program for small businesses.

It would also address some major Democratic demands: $75 billion for hospitals and $25 billion for testing.

Some $60 billion in the new funding for the Paycheck Protection Program would be targeted specifically for smaller financial institutions to ensure loans for minority and lower-served areas.

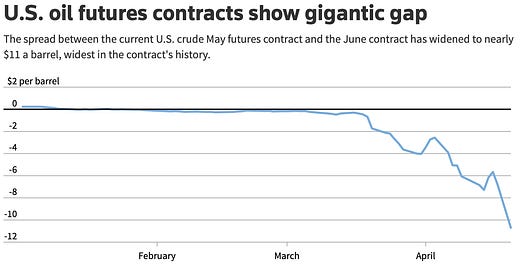

Oil suffered its biggest one-day price plunge in the modern era, at one point crashing about 40% to below $11 a barrel as traders contended with an historic glut. As storage space runs low for the glut of crude oil no longer needed by economies hard hit by the coronavirus, oil prices are slumping. The swelling glut of oil has outweighed efforts by global oil producers to curb production. (Bloomberg, Wall Street Journal)

Leading fracking firm Halliburton reported a $1 billion first quarter loss and $1.1 billion in impairment charges on Monday as it gave a bleak outlook for North American oilfields after the coronavirus-driven oil price decline. (Reuters)

A trio of far-right, pro-gun provocateurs is behind some of the largest Facebook groups calling for anti-quarantine protests around the country, offering the latest illustration that some seemingly organic demonstrations are being engineered by a network of conservative activists. The Facebook groups target Wisconsin, Ohio, Pennsylvania and New York, and they appear to be the work of Ben Dorr, the political director of a group called “Minnesota Gun Rights,” and his siblings, Christopher and Aaron. By Sunday, the groups had roughly 200,000 members combined. (Washington Post)

Michigan residents favor Gov. Gretchen Whitmer's handling of the coronavirus over that of President Donald Trump, according to a poll done for the Detroit Regional Chamber that was released Monday. A survey of 600 Michiganians found 57% approved of the Democratic governor's handling of the COVID-19 pandemic compared with 37% of respondents who disapproved. The finding came after more than 4,000 protesters descended on Lansing and the Capitol to protect Whitmer's tightened stay-home order that was extended through April 30. (Detroit News)

Do you trust what this person or agency says about the pandemic? (NBC News/WSJ poll)

CDC: Trust: 69%; Don't trust: 13%

Your governor: Trust: 66%; Don't trust: 20%

Anthony Fauci: Trust: 60%; Don't trust: 8%

Joe Biden: Trust: 26%; Don't trust: 29%

Donald Trump: Trust: 36%; Don't trust: 52%

Asia’s airports have reached “rock bottom.” The Airports Council International (ACI) Asia-Pacific said new data up to mid-April from 18 of its hubs in “major aviation markets” showed a 95 per cent collapse in passenger volumes year on year. Hong Kong International Airport was on track for a 99.5 per cent decline. (South China Morning Post)

Nations credited with fast response to coronavirus are moving to gradually reopen businesses: Germany and South Korea — role models in handling the outbreak in their respective regions — are slowly reversing some of the restrictions put in place weeks ago, embarking on a cautious and long path back to normality that could serve as a template for other nations. (Washington Post)

However, stirrings of unrest globally could portend turmoil as economies collapse (Washington Post):

India: Tens of thousands of migrant laborers stranded without work or a way home staged demonstrations last week in Mumbai

Lebanon: Angry people have swarmed onto the streets in Beirut and the northern city of Tripoli on at least three occasions.

Iraq: here have been spontaneous but brief outbursts of rage in the city of Nasiriyah and the impoverished Baghdad neighborhood of Sadr City.

Kenya: As of Saturday, as many people had died in police crackdowns on citizens defying curfew as of covid-19.

South Africa: Tries to ease internal Lesotho tension after PM deploys army. (Reuters)

Russia: Several hundred demonstrators in southern Russia have protested a strict lockdown amid the new coronavirus pandemic. (AP)

British household finances have reached their weakest point since November 2011, according to IHS Markit’s UK household finance index. Meanwhile, British banks should use their substantial capital and liquidity buffers to support the economy, the Bank of England said. (The Guardian, Reuters)

Deep-rooted problems lay ahead for Britain’s food supplies which are set to come under increasing strain as lockdown is extended for at least another three weeks and could go on for much longer. The problem is not that there is not enough food but that the well-established routes that supply it have been upended so abruptly. (The Independent)

Earnings & Companies:

Shake Shack is returning a $10 million loan it received from the US government under an emergency program that was touted as a way to help small businesses pay workers and keep their operations running during the coronavirus crisis. (CNN)

Walt Disney Co. will stop paying more than 100,000 employees this week, nearly half of its workforce, as the world’s biggest entertainment company tries to weather the coronavirus lockdown. (Los Angeles Times)

24 Hour Fitness weighs bankruptcy and is working with advisors at Lazard and Weil, Gotshal & Manges to weigh options including a bankruptcy that could come as soon as the next few months. (CNBC)

United Airlines on Monday reported a $2.1 billion loss for first quarter. The Chicago-based airline said has applied for up to $4.5 billion in government loans on top of about $5 billion federal payroll grants and loans it also expects to receive to weather the crisis. (CNBC)

Walmart is being tested like never before by a coronavirus pandemic that has shut down much of the nation, put 10% of its workforce on leave and led to at least 18 deaths at the company. Starting next week, Walmart plans to require all workers to wear masks. (Wall Street Journal)

Richard Branson pledges to mortgage Caribbean home to help business. The offer comes as Virgin Australia teeters on brink of collapse after failing to secure bailout. (Financial Times)

US truck-stop giant TravelCenters of America is furloughing 2,900 workers as the coronavirus continues to clobber the trucking industry. (Business Insider)

Novartis won the go-ahead from the U.S. Food and Drug Administration to conduct a randomized trial of malaria drug hydroxychloroquine against COVID-19 disease, the Swiss drugmaker said on Monday, to see if it helps patients. The decades-old generic medicine got FDA emergency use authorization this month for its unapproved use for coronavirus disease, but so far there is no scientific proof it works. (Reuters)

Poverty in the United States could reach highest levels in over 50 years: Columbia University Center on Poverty & Social Policy projects that if unemployment rates rise to 30 percent, the annual poverty rate in the United States will increase from 12.4 percent to 18.9 percent. This represents an increase of more than 21 million individuals in poverty and would mark the highest recorded rate of poverty since at least 1967. Even with a quick recovery in employment rates after the summer, we project that the annual poverty rate will reach levels comparable to the Great Recession. (Columbia University Center on Poverty & Social Policy)

Finance

For the first time since September 2004, no merger and acquisition deal worth more than $1 billion was announced worldwide last week, according to data provider Refinitiv, as the new coronavirus stifles global M&A. Worldwide merger activity so far this year is down 33% from a year ago and at $762.6 billion is the lowest year-to-date amount for dealmaking since 2013, the data showed. The number of deals also fell 20% year-on-year. (Reuters)

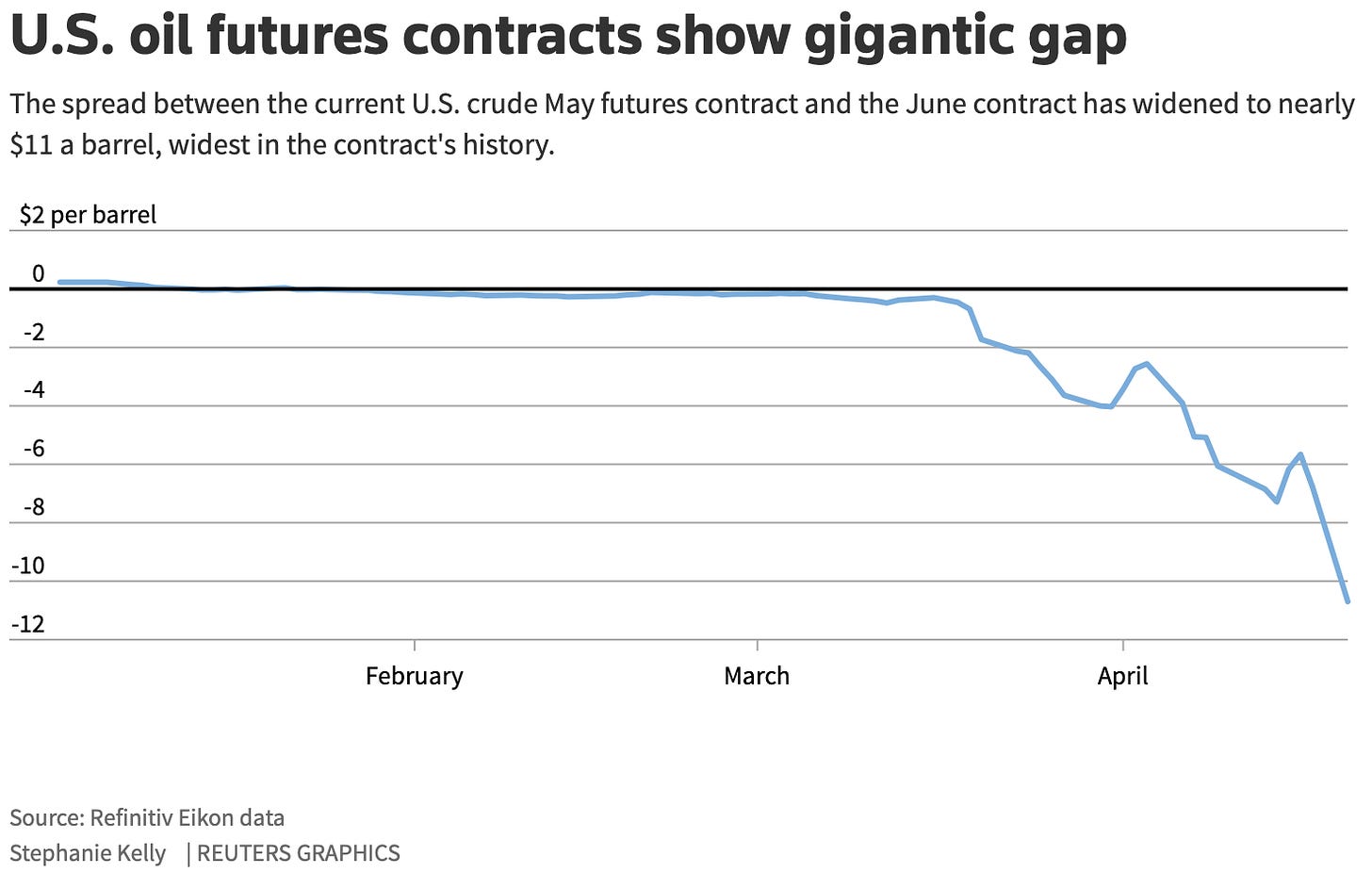

Short sellers have revived their wagers against the stock market in recent weeks, taking their most aggressive positions in years. Bets against the SPDR S&P 500 Trust, the biggest exchange-traded fund tracking the broad index, rose to $68.1 billion last week, the highest level in data going back to January 2016. (Wall Street Journal)

Carta, a startup that manages employee equity for other startups (including Axios), last week laid off 161 employees, or around 16% of its staff. Carta arguably is an index for startups, which makes these layoffs a major indicator. (Axios)

As U.S. financial markets have rebounded feverishly this past month from the worst of the coronavirus-induced sell-off, one asset has been conspicuously absent from the rally: the collateralized loan obligation. Prices in key parts of the almost $700 billion market have remained deeply depressed, typically fetching less than 70 cents on the dollar. (Bloomberg)

In China, local governments will sell an extra $141 billion in bonds as fiscal revenue plunges. Beijing gives green light for further bond sales to fire up post-epidemic recovery. (Caixin Global)

Fourth time a charm? (h/t Finance 202)

Technology

Alibaba said Monday it would invest 200 billion yuan ($28.26 billion) in its cloud computing division over the next three years, focusing on infrastructure. The money will be used to invest in technologies related to operating systems, servers, chips and networks. Alibaba is the biggest cloud computing provider by market share in China but it trails U.S. giants Amazon and Microsoft globally. (CNBC)

Zoom’s security woes were no secret to business partners like Dropbox.

Dropbox privately paid top hackers to find bugs in software by the videoconferencing company Zoom, then pressed it to fix them. The former Dropbox engineers said they were stunned by the volume and severity of the security flaws that hackers discovered in Zoom’s code — and troubled by Zoom’s slowness in fixing them. (New York Times)

India warns Zoom is 'not safe' and should not be used. (The Independent)

Uber is set to revive goods-delivery service in hunt for new revenue sources. Its drivers will transport items ranging from medical supplies to pet food. (Financial Times)

Facebook moves:

Facebook released its first map that tracks coronavirus symptoms county-by-county, which it plans to update daily throughout the outbreak. Facebook partnered with researchers from Carnegie Mellon University to create an opt-in survey designed to help identify Covid-19 hotspots earlier. The map breaks down the percentage of people per county who have self-reported coronavirus symptoms, such as loss of smell, cough and fever. (CNBC)

Facebook plans to introduce the Facebook Gaming mobile app on Monday, the social network said, in its most decisive move into the video game business as people seek entertainment during the pandemic. The app is designed largely for creating and watching live gameplay, a fast-growing online sector where Facebook is battling Amazon’s Twitch, Google’s YouTube and Microsoft’s Mixer services. (New York Times)

The anti-Huawei movement continues even as attention shifts to the coronavirus, with a group of tech firms urging the U.K. to find alternatives to using Huawei gear in 5G networks. (Axios)

Smart Links

How Earth Day was born. (Harvard Gazette)

China mobile lost almost 4 million subscribers in first quarter. (Bloomberg)

U.S. unemployment rising faster for women and people of color. (Harvard Business Review)

Dwindling supplies of carbon dioxide from ethanol plants are sparking concern about shortages of beer, soda and seltzer water. (Reuters)

Harvard Business School virtual event: The Future of Food: Helping the World One Bite at a time, with Philip Behn, CEO of Imperfect Foods and Rebekah Moses, Head of Impact Strategy from Impossible Foods. Register here.

Sen. Amy Klobuchar is the next guest on Joe Biden’s podcast “Here’s the Deal.” (Podnews)

Video: How to obtain a nasopharyngeal swab specimen. (New England Journal of Medicine)

Professional gamblers qualify for Nevada unemployment amid crisis. (Las Vegas Sun)

Good News

Cuomo issues order allowing New Yorkers to obtain marriage licenses over Zoom. (The Verge)

Retail wine sales surge online. (Washington Post)

Cardboard fans — yes, wearing masks — in the stands, as Taiwan professional baseball season begins. (South China Morning Post)

Thanks for reading. Did you like the newsletter? Why not subscribe now?