Today’s posts that caught my eye:

Mortgage rates are high because nobody is buying mortgages, the WSJ reports: “Banks have stepped back from buying mortgage bonds. So has the Federal Reserve, the largest investor in that market. Foreign buyers and money managers are curtailing purchases too, analysts say.”

Why can’t pollsters reach Gen Z: Traditional wisdom and poor polling methods fail to reach young people.

The brains of Black adults in the U.S. age more quickly than those of white and Hispanic adults, showing features linked to Alzheimer's and other dementias as early as mid-life, according to a new study in JAMA Neurology.

Thank you for subscribing. Know someone who should check out the newsletter? Let them!

The World

Western leaders on high alert after explosion in Poland kills 2:

Warsaw said was a strike by a “Russian-made missile” in the countryside near its border with Ukraine. US president Joe Biden said it was “unlikely” that the missile had been fired from Russia. (Financial Times)

World leaders on three continents raced to find answers. President Biden held urgent phone calls with their Polish counterparts and “offered full U.S. support for and assistance with Poland’s investigation” and reiterated America’s “ironclad commitment to NATO.” (Politico)

Russia fired roughly 100 missiles at targets across Ukraine, one of the broadest aerial attacks since the invasion began, causing blasts in at least six regions including Kyiv, the capital, just days after Moscow retreated from a key city in the south. President Volodymyr Zelensky of Ukraine said in a video posted on Telegram that most of the strikes targeted the country’s energy systems. (New York Times)

The U.S. is studying how to modify a powerful drone which has long been requested by Ukraine’s military. The changes to the multi-use Gray Eagle would make the possibility of losing any - with their sensitive onboard technology - less of a danger, potentially increasing the likelihood of Ukraine receiving them. (CNN)

Biden-Xi Talks Mark Shift in U.S.-China Ties Toward Managing Fierce Competition: The meeting between Mr. Biden and Chinese leader Xi Jinping stretched over three hours, covering thorny issues such as their differences over Taiwan, Russia’s war in Ukraine and ways to ensure that the U.S.-China rivalry doesn’t flare into open conflict. Mr. Xi offered a firm defense of Communist Party rule in China and grew particularly animated when he spoke about Taiwan, providing a detailed history of the self-ruled island that Beijing sees as part of its territory, according to Chinese officials. But Mr. Biden and his advisers also came away with the impression that China had no imminent plans to invade Taiwan, although Mr. Xi didn’t say so explicitly, one of the U.S. officials said. To Mr. Biden’s team, it appeared the Chinese leader was seeking stability and predictability at an uncertain time in China. In the end, the meeting largely accomplished what the two sides set out to achieve, restoring dialogue between the two major powers and a measure of stability to a relationship that had deteriorated to its lowest point since the 1970s. (Wall Street Journal)

Xi’s crackdowns drive Chinese billionaires to booming Singapore. The exodus of wealth is poised to accelerate after last month’s Party Congress in which President Xi Jinping further tightened his grip on the economy. Xi’s drive for “common prosperity” means entrepreneurs -- who once embraced Deng Xiaoping’s maxim that to get rich is glorious -- are flocking to more welcoming places like Singapore. (Bangkok Post)

The U.S. Navy has intercepted a “massive” shipment of explosive material in the Gulf of Oman. The material was transiting from Iran along a route that has been used to traffic weapons to Yemen’s Houthi group. A Saudi-led military coalition battling the Iran-aligned Houthis in Yemen since 2015 has repeatedly accused Iran of supplying the group with weapons - a charge Tehran denies. (Reuters)

Donald Trump, twice impeached and under FBI investigation, launches 2024 White House bid. (CNBC)

Trump’s candidacy won’t stop criminal probes by Justice Department. (Washington Post)

Murdoch tells Trump he will not back fresh White House bid: Media mogul turns to ‘DeFuture’ Ron DeSantis after ex-president’s poor showing in midterm elections. (The Guardian)

Networks limit Trump's airtime during 2024 announcement. (Politico)

Enough. (NY Times Editorial Board)

Why can’t pollsters reach Gen Z: Traditional wisdom and poor polling methods fail to reach young people. (The Verge)

More than 60% of the Massachusetts electorate is now unenrolled with no party affiliation. (WBUR)

Several Kentucky supreme court justices sound skeptical of state’s near-total abortion ban. In Georgia, the state’s abortion ban after six weeks is blocked. (CNBC, Wall Street Journal)

Humans could face reproductive crisis as sperm count declines, study finds. A study published in the journal Human Reproduction Update, based on 153 estimates from men who were probably unaware of their fertility, suggests that the average sperm concentration fell from an estimated 101.2m per ml to 49.0m per ml between 1973 and 2018 – a drop of 51.6%. Total sperm counts fell by 62.3% during the same period. (The Guardian)

Brains of Black Americans age faster, study finds, with 'weathering' likely to blame: The brains of Black adults in the U.S. age more quickly than those of white and Hispanic adults, showing features linked to Alzheimer's and other dementias as early as mid-life, according to a new study in JAMA Neurology. The analysis of MRI scans found that Black adults — on average, in their mid-50s — were more likely than white or Hispanic adults of the same age to have a higher prevalence of white matter lesions, markers of cerebrovascular disease that are associated with cognitive decline and Alzheimer’s disease. The new research strengthens the case that vascular disease may be especially detrimental to brain health in Black populations, and earlier in life than previously thought. The differences are unlikely to be genetic, the scientists said, hypothesizing that early brain aging in Black participants may be linked to weathering — the accumulation of racial stressors over time. (STAT News)

Flu season has roared to life in California, reaching levels not seen in years and threatening to further strain a healthcare system already contending with an onslaught of RSV cases and still-potent circulation of the coronavirus. (Los Angeles Times)

Economy

Morning Consult’s latest data suggests that core CPI inflation is likely to increase in November after falling dramatically in October. All five of Morning Consult’s Supply Chain Indexes of Consumer Inflation Pressures showed signs of easing in October — the first time this has happened since tracking began in March. Their movements also coincided with a substantial decline in the rate of Consumer Price Index inflation, as consumers experienced a welcome reprieve from the sting of rapid price growth, particularly for “core” (excluding food and energy) prices. (Morning Consult)

Mortgage Rates Could Tank Home Prices by 20%, Fed Study Finds: Average 30-year fixed-rate mortgages now top 7%, the highest in more than two decades. (Bloomberg)

Year-end bonuses are expected to be much lower this year than in the bonanza of 2021. M&A slowed, IPOs dried up and revenue declined. Investment bankers are expected to do the worst, with bonuses plunging as much as 45%. No surprise given the drop-off in deal-making. "Economic headwinds showed no signs of abating," Alan Johnson, managing director of Johnson Associates, which released the estimates, said. (Axios Markets)

Mortgage Rates Are High Because Nobody Is Buying Mortgages: Banks went on a mortgage-bond buying spree last year, but now they are stepping back from the market. “Banks stepping back, the Fed stepping back, foreign investors stepping back—that has widened the spread that mortgages trade at versus Treasurys, which directly translates to the borrower’s mortgage rate,” said Nick Maciunas, a research analyst at JPMorgan Chase & Co. (Wall Street Journal)

Paris overtakes London as Europe’s largest stock market. Paris has taken the top spot after the combined market capitalisation of its major share exchanges overtook those in the UK capital. Currency movements have also helped Paris, with the pound down 13% against the dollar this year, while the euro has only lost 9%. (Bloomberg)

Is the FTX crash Gensler’s fault — or did it prove he’s right? The SEC chair has been criticized for failing to offer regulatory clarity. But the crisis vindicates his approach to the controversial industry, others say. Marc Fagel, former SEC regional director for San Francisco who has represented crypto companies in his private practice, downplayed speculation that the SEC colluded with FTX simply because Gensler’s staff had meetings with the company. “Plenty of players in the crypto industry have met with various members of the SEC,” Fagel told Protocol. “Indeed, I would be a little worried if the SEC didn’t take meetings with players as large as this.” (Protocol)

FTX Founder Sam Bankman-Fried Attempts to Raise Fresh Cash Despite Bankruptcy. (Wall Street Journal)

Reconcile these headlines:

Walmart lifts guidance as richer consumers go bargain hunting. (Financial Times)

Luxury market forecast to grow despite global recession fears. (Financial Times)

Technology

More than 1 billion teenagers and young adults may be at risk of hearing loss because of their use of headphones, earphones and earbuds and attendance at loud music venues, a study suggests. An international team of researchers estimate that 24% of 12- to 34-year-olds are listening to music on personal listening devices at an “unsafe level”. The findings were published in the journal BMJ Global Health. (The Guardian)

TCI Fund Management told Google parent Alphabet in a letter that it needs to aggressively cut costs. TCI Fund Management, the activist hedge fund, sent the letter to Alphabet Chief Executive Sundar Pichai on Tuesday. TCI said the cost base of Alphabet “is too high and management needs to take aggressive action.” (Barron’s)

Apple is preparing to begin sourcing chips for its devices from a plant under construction in Arizona, marking a major step toward reducing the company’s reliance on Asian production. (Bloomberg)

Mobile game revenue will decline for the first time in history this year. While the whole game industry is expected to contract by 4.3% — another first since Newzoo began tracking the market in 2007 — the company is predicting a 6.4% decline in mobile game spending on top of a 4.2% decline in console game spending. (Protocol)

Amazon launched Amazon clinic, a virtual platform where users can connect with healthcare providers to help treat common ailments like allergies and skin conditions. Amazon has for years sought to expand its presence in healthcare. It bought online pharmacy PillPack in 2018, underpinning a prescription delivery and price-comparison site it later launched as Amazon Pharmacy, which lets users buy over-the-counter drugs via Prime memberships. (Reuters)

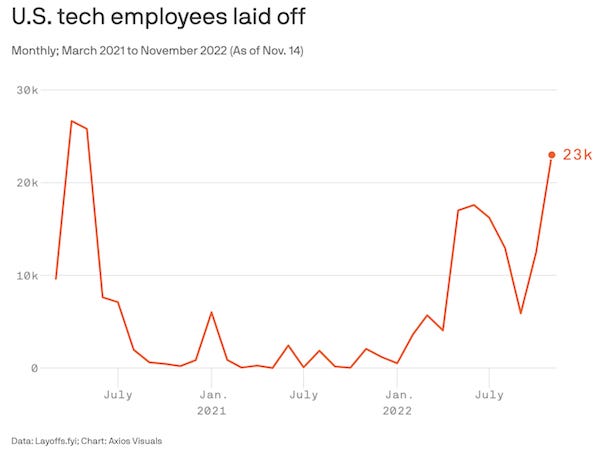

Unemployment overall is low, but you wouldn't feel that way if you worked in tech — or the mortgage industry. These are the sectors feeling the most pain from the Fed's rate hikes. Many of these companies were buoyed by low rates, skyrocketing equity values, and an overly optimistic view of the future. Plus: A hyped-up "war for talent" led some companies to hire too fast and spend too much. Some of that hiring was "sloppy," one recruiter told Axios. It was only a few months ago that Amazon raised its maximum base pay level for these corporate employees to $350,000 a year, from $160,000, amid a fever-pitch drive to hire throughout the sector. (Axios Markets)

Silicon Valley is reeling. Is this the end of the cushy tech job? The tight labor market put more power in the hands of workers, which — at least in Big Tech — has led to a shift away from hustle culture and toward work-life balance, self-care, and, some would argue, “quiet quitting.” Now it seems like a return to hustle culture is bubbling up from this month’s bloodbath of layoffs. (Protocol)

Chinese tech giant Tencent Holdings has begun a new round of job cuts targeted at its video streaming, gaming and cloud businesses. (Reuters)

Meta’s layoffs make it official: Facebook is ready to part ways with the news. (Nieman Journalism Lab)

Musk tells Twitter employees they can still receive stock even though the company is private. (CNBC)

Smart Links

Tech Firms Dump Office Space as They Downsize. (The Wall Street Journal)

Parents are missing work at record rates to take care of sick kids. (Washington Post)

Taylor Swift tour tickets listed for as much as $22,000 as Ticketmaster crashes. (The Guardian)

The snubs and surprises of the 2023 Grammy nominations. (Vulture)

Airbnb Co-Founder’s New Business Is Building Small Homes in Backyards. (Wall Street Journal)

Gas prices dive just in time for Thanksgiving road trips. (Los Angeles Times)

Ad Markets Struggled in Q3. (A Media Operator)

Job listings are the new Zillow. (Axios Markets)

How a design tweak could help pacemaker batteries last longer. (Popular Science)

Good News

Speedcuber solves 6931 cubes in 24 hours smashing world record: 20-year-old George Scholey (UK) has achieved the record for the most rotating puzzle cubes solved in 24 hours with an incredible 6,931. Finishing up his record this morning on Guinness World Records Day, George was whisked away to be presented with his official record certificate by GWR Editor-In-Chief Craig Glenday. (Guinness World Records)

Steve Jobs’ old Birkenstocks sell for nearly $220,000: ‘Well-worn’ German sandals owned by Apple co-founder set record at auction. (The Guardian)

Thank you for subscribing to my newsletter. Know someone you think would like it?