Today’s posts that caught my eye:

Iranian activists smuggle Starlink receivers into the country for a backup internet.

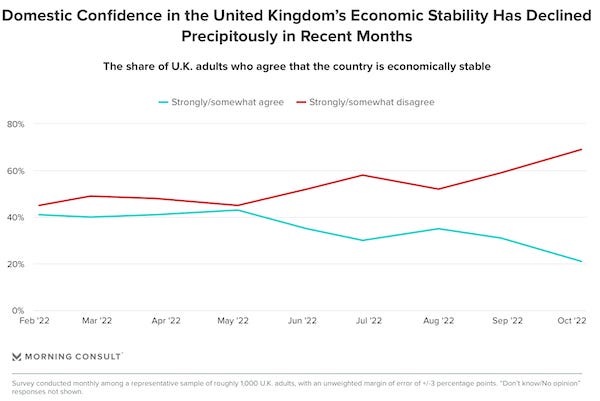

Transatlantic travel is booming, driving airline revenue as Americans armed with a strong US dollar fly to Europe and the UK.

Zoom, Teams, Slack are wreaking havoc on employee productivity, Bloomberg reports. Shifting between multiple apps to get stuff done drains workers’ time, efficiency and engagement.

Thank you for subscribing. Know someone who should check out the newsletter? Let them!

The World

Xi Jinping leaves no doubt who is in charge of China: Chinese President Xi Jinping looked to fresh faces to confront new term of ‘unparalleled complexity’. Four younger leaders were promoted to the Politburo Standing Committee but there are no obvious successors among them. Choices for Communist Party’s top decision-makers point to preference for experience in science, technology and security — in part to help push back at US tech squeeze. “It represents a massive consolidation of Xi’s power that is unprecedented since the Mao era,” said Neil Thomas, senior China analyst at the consultancy Eurasia Group. (The Economist, South China Morning Post, Financial Times)

The unveiling of the leadership this year was eclipsed by the closing session of the party’s 20th congress on Saturday, during which Xi’s predecessor was escorted off the leadership rostrum. State media did not immediately report the incident and censors blocked social media accounts that circulated video clips or commented about it. China’s official Xinhua news agency later said on Twitter that Hu Jintao, 79, “insisted on attending the closing session despite the fact that he has been taking time to recuperate recently”. “When he was not feeling well during the session, his staff, for his health, accompanied him to a room next to the meeting venue for a rest,” it added. “Now he is much better.” (Financial Times)

China’s economy grew faster than expected in 3Q22 with industrial activity improving despite Covid restrictions and a property slump, but retail sales weakening. 3Q22 GDP grew 3.9% from a year ago, stronger than the median estimate of 3.3% growth expected by economists in a Bloomberg survey. It was far better than the 0.4% increase recorded in2Q22, during the Shanghai lockdown. (Bloomberg)

Rishi Sunak set for No 10 as Boris Johnson quits race: Boris Johnson pulled out of the Conservative leadership contest tonight, paving the way for Rishi Sunak to become Britain’s next prime minister. His decision means that Sunak, who was already the frontrunner, could be named as Liz Truss’s successor as soon as today. (The Times)

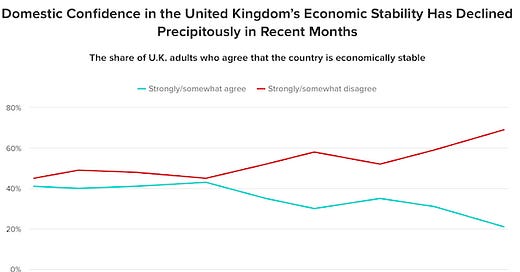

21 percent of British adults say they at least somewhat agree that the country is economically stable, down 22 percentage points from May as political and economic turmoil have engulfed the United Kingdom. (Morning Consult)

North and South Korea exchanged warning shots off the west coast, accusing each other of breaching their western maritime border amid heightened military tension. The South's Joint Chiefs of Staff (JCS) said it broadcast warnings and fired warning shots to see off a North Korean merchant vessel that crossed the Northern Limit Line (NLL), the de facto sea boundary, at around 3:40 a.m. (Reuters)

Iranian activists smuggle Starlink receivers into the country for a backup internet, citing “no Starlink donation” from SpaceX nor US government participation. (Time)

Biden Pitches Plan to Refill Oil Reserves, but Producers Are Skeptical: U.S. companies are wary of boosting output even though the government is offering to buy oil at fixed prices. (Wall Street Journal)

U.S. sets new record for migrant border crossings: Migrant border crossings in the 2022 fiscal year topped 2.76 million, breaking the previous record, according to data from Customs and Border Protection. The sharp increase in border crossings comes as the Biden administration has faced challenges in trying to formalize its own border policy. The CBP said it stopped migrants more than 2,766,582 times for the 12 months ending on Sept. 30, 2022, which is much higher than the 1.72 million times from the previous fiscal year. (Axios)

Salman Rushdie has lost sight in one eye and the use of one hand after the attack he suffered while preparing to deliver a lecture in New York state two months ago, his agent has confirmed. The 75-year-old author, who received death threats from Iran in the 1980s after his novel The Satanic Verses was published, was stabbed in the neck and torso as he came on stage to give a talk on artistic freedom at the Chautauqua Institution on 12 August. (The Guardian)

Red Wave Watch: Polling, spending trends and conversations with leading Democratic and Republican strategists suggest it’s now very possible House Republicans win back the majority on Nov. 8 with more than 20 House seats — once the upper range of most analysts’ projections, Axios reports. Two weeks out from the midterms, evidence points to a re-emerging red wave that could sweep in GOP control of both chambers. In the Senate, Republican officials are now bullish they’ll gain at least the one seat necessary to regain the majority. There’s also an outside chance it sweeps in flawed Republican Senate nominees in Georgia and Arizona — despite their underwhelming campaigns against battle-tested Democratic incumbents. (Political Wire)

Midterm Voting Intentions Are Divided, Economic Gloom Persists: With less than three weeks to go until the midterm elections, registered voters’ preferences are nearly evenly divided: 41% say they favor the Democratic candidates in their districts, while a nearly identical percentage (40%) support Republican candidates; 18% are not sure how they will vote or favor candidates other than Republicans or Democrats. And those supporting GOP candidates are somewhat more engaged this election than their Democratic counterparts: They are more likely to have thought “a lot” about the election and to say the outcome “really matters.” As has been the case all year, the economy is clearly the top issue for voters; fully 79% say it will be very important to their voting decisions – the highest share among 18 issues included on the survey. The public continues to take a dim view of current economic conditions. Just 17% of U.S. adults say the economy is in excellent or good shape, little changed from the 13% who said this in July. (Pew Research Center)

Bubonic plague left lingering scars on the human genome: The bubonic plague, which was caused by the bacterium Yersinia pestis, might have left its mark on the genes involved in the modern human immune system. Four DNA variants, in particular, seem to have become more common after the Black Death, and might have contributed to survival. The protection afforded by those variants could have come at a cost: today, two of them are associated with an increased risk of autoimmune disorders, such as Crohn’s disease and rheumatoid arthritis. (Nature)

You’re not imagining it: Halloween treats are getting smaller. Consumers can partly blame “shrinkflation” — the phenomenon of manufacturers reducing the size of their products rather than increasing the price. But it’s also part of a years-long plan to make Americans’ candy less caloric. (Washington Post)

Transatlantic travel is booming, driving airline revenue as Americans armed with a strong US dollar fly to Europe and the UK. Revenue at United Airlines from trips between the US and Europe rose 40 per cent in the third quarter compared with the same period in 2019, to $2.5bn. The average fare on those trips climbed 30 per cent compared with a year earlier. The strong dollar has been “useful” in prompting US travellers to book trips to Europe, said United’s chief commercial officer Andrew Nocella. What was an “incredible” summer season has maintained momentum into the autumn. The airline debuted multiple new routes last summer, flying 14 per cent more seats across the Atlantic than it did in 2019, and it plans to add more routes next year. “It’s full speed ahead across the Atlantic,” Nocella said. (Financial Times)

Economy

US strong enough to avoid recession, says Biden economic adviser: Joe Biden’s top economic adviser said the US economy had the “strength and resilience” to shield it from a recession, brushing off growing concerns that steep interest rate increases designed to fight inflation will quash the expansion. Brian Deese, the director of the White House’s National Economic Council, spoke to the Financial Times as economists and chief executives are increasingly warning that the world’s largest economy will experience a downturn next year on the back of global weakness and much tighter monetary policy. But the Biden administration is sticking to its view that the US will experience a form of “soft landing” with a shift to slower growth rather than a deep contraction, and a cooling of job growth rather than mass lay-offs. (Financial Times)

Higher Interest Rates Can Take a Long Time to Bring Down Inflation. (Wall Street Journal)

Amazon, Apple and Meta are among the tech heavyweights featured in a packed week of earnings that investors will probe for indicators about the broader economy. Other tech companies scheduled to report their latest quarterly reports include Google parent company Alphabet Inc. and Microsoft Corp. Investors also will hear from airlines such as Southwest Airlines Co. and JetBlue Airways Corp., automotive companies General Motors Co. and Ford Motor Co., and energy giants Chevron Corp. and Exxon Mobil Corp. Nearly a third of the S&P 500, or 161 companies, are slated to report earnings in the coming week, according to FactSet. Twelve bellwethers from the Dow Jones Industrial Average, including Boeing Co. and McDonald’s Corp., are expected to report as well. (Wall Street Journal)

Bond Market Sees No End to Worst Turbulence Since Credit Crash: For bond traders, the upward drift of Treasury yields hasn’t been that hard to predict. It’s the short-term swings that are vexing. The world’s largest bond market is being whipsawed by its longest stretch of sustained volatility since the onset of the financial crisis in 2007, marking a stark break with the stability seen during the long era of historically low interest rates. And the uncertainty that’s driving it doesn’t appear set to fade anytime soon: inflation is still running at a four-decade high, the Federal Reserve is raising interest rates aggressively, and Wall Street is struggling to gauge how well a still-resilient economy will hold up. (Bloomberg)

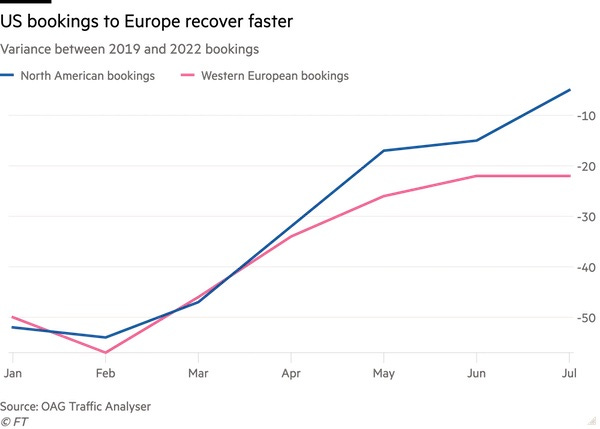

Office workers embrace hybrid working as post-pandemic norm: People across the world’s largest economies have not gone back to pre-Covid commuting patterns, data shows. (Financial Times)

Zoom, Teams, Slack Are Wreaking Havoc on Employee Productivity: Shifting between multiple apps to get stuff done drains workers’ time, efficiency and engagement. (Bloomberg)

Technology

Explainer: How the US chip export controls have turned the screws on China. Washington is trying to slow Beijing’s advanced semiconductor development and military modernization. The controls are arguably the toughest measures President Joe Biden has taken against China and his first serious attempt to slow its military modernization by targeting the technologies behind everything from nuclear weapons modeling to hypersonic weapons development. “When Huawei was targeted, it was trade tensions during peacetime. Now we’re in a state close to war,” said Hideki Wakabayashi, professor at Tokyo University of Science, referring to the Chinese telecoms equipment group. Questions addressed: 1) How will they impact China’s semiconductor industry? 2) What US companies will be hit? 3) Will China retaliate? 4) Will there be spillover to other industries? 5) What has been the global fallout? (Financial Times)

Taiwan Semiconductor Manufacturing Co. has suspended production of advanced silicon for Chinese startup Biren Technology to ensure compliance with US regulations, according to a person familiar with the matter. The decision is connected with information in the public domain that Biren’s products outperform Nvidia Corp.’s A100 chips, which are now banned for the Chinese market. (Bloomberg)

Meta has warned Canada it is prepared to block the sharing of Canadian news content—like it did in Australia last year—unless the Liberal government amends legislation that would compel big digital companies to compensate domestic media outlets. The legislation is under review by a parliamentary committee, and lawmakers voted this week to stop hearing further testimony from witnesses. Facebook said it wasn’t given an opportunity to testify, so late Friday it issued a statement outlining the company’s concerns with Canada’s proposed rules—and a warning. (Wall Street Journal)

Tesla cuts starter prices for Model 3, Model Y in China by up to 9%. (Reuters)

Smart Links

Today’s Strong U.S. Dollar Can Save Money on Travel to Europe Next Year. (Wall Street Journal)

UK’s crumbling commercial property valuations and sales signal looming slump. (Financial Times)

In America and eastern Europe, covid-19 got worse in 2021: Middle-aged people accounted for the biggest losses in life expectancy. (The Economist)

Japan finance minister declines to say whether government intervened to prop up yen. (Reuters)

Disney, ESPN Officially Ink New Long-Term Rights Deal With Formula 1. (The Hollywood Reporter)

An edible for hot flashes? Some women use cannabis to manage menopause. (Washington Post)

Exposure to environmental toxins may be root of rise in neurological disorders. (The Guardian)

You’re not the only one accidentally turning on your iPhone flashlight. (Washington Post)

Good News

Yes, the Comedy Wildlife Photo Finalists Are as Hilarious as You Would Expect. (Wall Street Journal)

The NBA season started last week. Here’s the hoops news you need:

Thank you for subscribing to my newsletter. Know someone you think would like it?