Headliners:

Please forward. Sending this to 5 people you think would like it is the best way to help me get the word out. Thank you.

Like the newsletter? Why not sign up for a paid subscription… During this two-week trial, you get the Founding Member Rate — 50% off the regular cost. Continued thanks to everyone who already has done so!

The World

The House passed the $484 billion spending bill with money for small businesses, hospitals and testing. Meanwhile, JPMorgan told some small business customers to apply with other banks on fear that funds will run out. (Washington Post, CNBC)

The Fed will begin disclosing loan amounts and names of borrowers in the business lending programs through monthly reports, while Treasury Secretary Steven Mnuchin asks for equity stakes in exchange for $17 billion in aid. (Wall Street Journal, Bloomberg)

Macy’s, Gap and TGI Fridays are among the big national chains saying they will sit out the early phase of reopening in states such as Georgia and South Carolina, citing health concerns and uncertain customer demand. (Wall Street Journal)

U.S. consumer sentiment fell for a third straight month as people weigh the coronavirus pandemic and the possibility of an economic re-opening, data released Friday by the University of Michigan showed. The consumer sentiment index fell to 71.8 in April from 89.1 in March. (CNBC)

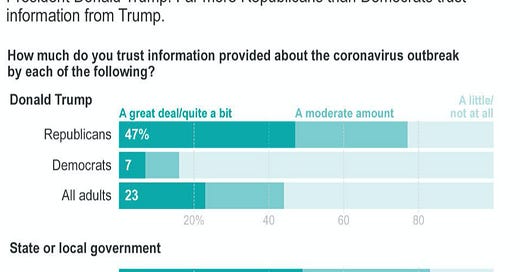

Just 28% of Americans say they’re regularly getting information from President Trump about the coronavirus and only 23% say they have high levels of trust in what the president is telling the public. Another 21% trust him a moderate amount. (Associated Press)

Britain’s economy could he heading into its deepest recession in more than 300 years, according to budget forecasters. British retail sales fell by the most on record in March, and the slump is likely to be even worse in April. (Reuters)

Warnings of worsening hunger, malaria emerge as coronavirus cases spike 40% in Africa. (Washington Post)

New York Governor Andrew Cuomo called Senate Majority Leader Mitch McConnell’s suggestion that states resort to filing for bankruptcy rather than seek financial aid from the federal government “irrepsonsible, reckless,” and “one of the really dumb ideas of all time.” (The Guardian)

With rising expenses, falling revenues, and budget cuts, universities face a looming financial crisis. (Washington Post)

The Gilead antiviral drug Remdesivir — which inspired a rise in global stocks on hopes for a rapidly available treatment and the initial positive University of Chicago clinical trial results — flopped in its first trial. (Financial Times)

Virus researchers say there is virtually no chance that the new coronavirus was released as result of a laboratory accident in China. (NPR)

Finance

Major U.S. credit-card issuers are starting to lower customer spending limits with individuals struggling to keep up on loans. (Bloomberg)

Hedge fund billionaire Leon Cooperman calls for higher taxes on the wealthy; the IMF calls for a Wealth Tax. (CNBC, Business Insider)

US banks are pulling back from lending to European companies, as JPMorgan, Goldman and BofA have become more cautious over loans. (Financial Times)

Rep. David Cicilline (D-R.I.), who chairs House Judiciary's antitrust subcommittee, yesterday proposed a moratorium on all M&A activity outside of situations in which companies are bankrupt or on the brink of insolvency. (Axios)

UBS expects 100,000 stores to permanently shut between now and the end of 2025. Tenants will then pull out of mall and shopping center leases with co-tenancy clauses. Online sales as a percentage of U.S. total retail sales are expected to grow to 25% from 15%. (CNBC)

The inequality gap is gaining notice within the pandemic discussions. A new study finds that between March 18 and April 10, 2020, over 22 million people lost their jobs as the unemployment rate surged toward 15 percent. Over the same three weeks, U.S. billionaire wealth increased by $282 billion, an almost 10 percent gain. (Finance 202, Institute for Policy Studies)

Technology

Zoom backlash intensifies: Daimler, Ericsson, NXP Semiconductors and Bank of America are among a wave of companies forbidding or warning employees against using Zoom because of security concerns. They join corporations like Tesla and government agencies from Taiwan to Singapore that have banned the app’s use, though the city-state has since backtracked. (Fortune)

Amazon employees have used data about independent sellers on the company’s platform to develop competing products. (Wall Street Journal)

Skype Media: The rough-and-ready video quality of journalism during the coronavirus crisis is changing the way we engage with the media. (New York Times)

Google will require all advertisers to identify themselves to begin cracking down on digital ads purveying fake products and coronavirus misinformation. (Wall Street Journal)

Why’d WhatsApp retreat on ads? Mark Zuckerberg suspended the push to introduce ads to the popular messaging app partly because Facebook wanted to avoid antagonizing regulators. Facebook also feared angering WhatsApp users who valued the app’s emphasis on privacy and who resisted the idea of having their accounts tied to Facebook. (The Information)

Smart Links

California suspends single-use plastic bag ban in grocery stores amid coronavirus exposure concerns. (Los Angeles Times)

Makers of Lysol warn against ingesting disinfectants. (New York Times)

How contact tracing technology works. (Quartz)

With spelling bee canceled, ex-spellers launch their own bee. (Education Week)

How to make the healthiest coffee. (European Society of Cardiology)

Flying may never be as cheap again. (Quartz)

Good News

Live Event @ 2 pm ET: What Is the Cost of Lies? A Discussion with HBO Chernobyl Writer and Creator Craig Mazin. (Harvard University)

Lucy Chiswell, the Dorset Curatorial Fellow for Paintings 1600-1800, explores a day in the countryside through paintings by Rubens, Constable and Corot. (The National Gallery)

Thanks for reading. Did you like the newsletter? Why not subscribe now?