Today’s posts that caught my eye:

Mortgage rates fall sharply to under 7% after inflation eases.

If you didn’t think the FTX story — the crypto leader’s implosion — could get crazier… you might want to read Sequoia’s characterization of their meeting with CEO Sam Bankman-Fried.

Gen Z Employees See Digital Tools as a Way to Win at the Office, Bloomberg reports: “New research from King’s College London showed that 40% of 16 to 24-year-olds with a workplace in the UK capital find it easier to volunteer for key tasks and ask questions when working remotely. Conversely, their older peers are more inclined to see working from home as a barrier to learning and networking.

Thank you for subscribing. Know someone who should check out the newsletter? Let them!

The World

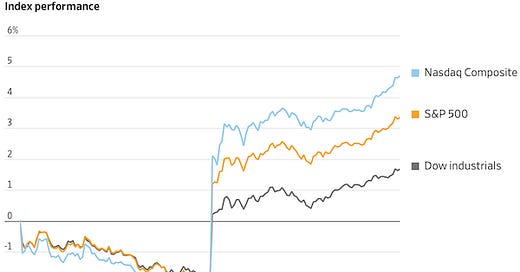

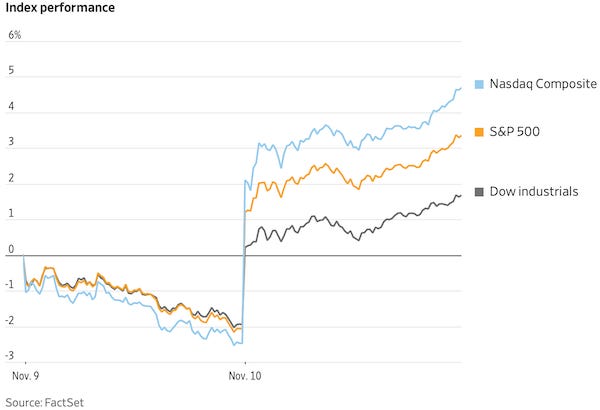

Dow Rises 1,200 Points on Signs of Easing Inflation: Stocks stage biggest rally since 2020 U.S. stocks had their biggest gains in more than two years, after softer-than-expected inflation data reignited bets that the Federal Reserve would slow the pace of its interest-rate increases. The Nasdaq jumped more than 7%, and Treasury yields had their steepest one-day declines in more than a decade. (Wall Street Journal)

Mortgage rates fall sharply to under 7% after inflation eases. The average rate on the 30-year fixed plunged 60 basis points from 7.22% to 6.62%. (CNBC)

It could be cheaper to eat out on Thanksgiving as CPI ‘food at home’ prices soar. (CNBC)

More than 50 of the poorest developing countries are in danger of defaulting on their debt and becoming effectively bankrupt unless the rich world offers urgent assistance, the head of the UN Development Programme has warned. (The Guardian)

U.S. set to face third Covid winter, this time without key tools and treatments. Free at-home tests are no longer showing up at people’s doorsteps. States are reporting outbreak data less frequently, and globally, testing and surveillance programs have been curtailed. Support for community vaccination campaigns has dwindled. And next year at some point, the U.S. government will stop paying for Covid vaccines and treatments, which could widen gaps in access as the products move to being covered by insurance. (STAT News)

Britons overwhelmingly say the U.K. is off the rails. The political tumult over the past several months has British adults feeling pessimistic about their country, with 83% saying it is on the wrong track, the highest proportion among all nations on Morning Consult's Global Leader Approval Ratings tracker. Still, that's actually down 6 percentage points since Oct. 25, when Rishi Sunak took the premiership, and while more disapprove than approve of Sunak, he is still polling better than his short-tenured predecessor did. (Morning Consult)

In the UK, worst-ever NHS waiting times are costing lives, say doctors’ leaders. Nearly 20,000 people a day are waiting at least four hours in A&E amid a dramatic collapse in NHS performance. Patients are dying avoidably as record numbers spend at least 12 hours stuck on a trolley in hospital corridors waiting for a bed to become available, doctors’ leaders say. Waiting times are worse than ever across almost all measures, including cancer and planned surgery. (The Times)

Nearly 2% of healthy infants hospitalized with RSV before first birthday, study finds. Dutch and British scientists, in a study published in Lancet Respiratory Medicine, found that 1.8% of healthy infants are hospitalized with RSV before their first birthday. The scientists found that a majority of the infants hospitalized with RSV were younger than 3 months. About 1 in 18 infants hospitalized with RSV required treatment in the intensive care unit. (CNBC)

Trump unloads on Ron "DeSanctimonious": Former President Trump lashed out at Florida Gov. Ron DeSantis in a lengthy diatribe tonight, branding his potential 2024 rival as an "average" Republican who owes his political success to Trump's endorsement in the 2018 governor's race. (Axios)

Trump goes to war against DeSantis. (Politico)

Donald Trump confirmed that he will be holding a “special announcement” at Mar-a-Lago on Nov. 15 in a press release on Thursday night. (Political Wire)

(CR note: This is a real headline) Rupert Murdoch Knees Trump in the Balls While He’s Doubled Over Coughing Up Blood: The message from the Murdoch-owned New York Post, Wall Street Journal, and Fox News is clear: Pack your bags, bitch. You’re done. (Vanity Fair)

Incivility on the front lines of business is on the rise. After all, as the pandemic wore on, we saw in real time how frontline workers went from being seen as “essential” to being seen as, essentially, punching bags. What might not be obvious is that incivility doesn’t affect only workers who experience it directly — it also affects those who witness it, with consequences for businesses and society. Christine Porath has studied incivility for more than 20 years, looking at the experiences at work of people around the world. Her research shows that business leaders have the power to improve things, both for workers and for society as a whole. (Harvard Business Review)

Improvements in addiction care disproportionately benefit white patients: Even though U.S. drug overdose deaths are hovering around an all-time high of 107,000 per year, there's a glimmer of hope in addiction medicine: Patients using buprenorphine, a common medication used to treat opioid use disorder, are staying in treatment longer. Those gains, however, are heavily concentrated among white patients, STAT's Lev Facher notes. (STAT News)

Economy

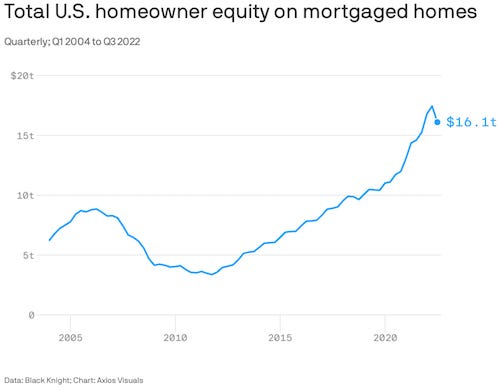

A whopping $1.37 trillion in mortgage holder equity vanished in the third quarter, thanks to falling home prices, according to calculations by mortgage technology firm Black Knight. It's the sharpest single-quarter decline, by dollar value, since 2000. On a percentage basis, it's the steepest drop since 2009. As this is real estate, so there are big variations depending on location. The most significant drops in equity are in San Jose (24%), Seattle (21%) and San Francisco (20%). (Axios)

U.S. home-price growth slowed sharply in the third quarter, as home-buying affordability remained near its lowest level in decades. (Wall Street Journal)

Profits continue to climb for payers as possible recession looms. Despite talk of a recession, all major insurers expect a rosier end to 2022 than previously predicted. On the other hand, profits fell for large hospital operators faced with pricier labor. (Healthcare Dive)

Top office developers hit the pause button on new projects. U.S. real-estate developers are delaying major office projects already under way or in the planning stages, discouraged by high vacancy rates and the reduction in workspace demand resulting from remote work. Some property developers view periods of economic uncertainty and weak office demand as good times to launch new projects. (Wall Street Journal)

Sam Bankman-Fried is being investigated by the US SEC for potential violations of securities rules. Officials in the Bahamas, where his FTX.com is based, froze the assets of FTX Digital Markets while also appointing a liquidator. Troubled crypto lender BlockFi said it can no longer operate business as usual, citing “a lack of clarity” in relation to FTX. Earlier, FTX.com founder Bankman-Fried said he’s closing Alameda Research, the trading house at the center of speculation about whether his crypto exchange mishandled customer funds. (Bloomberg)

FTX Tapped Into Customer Accounts to Fund Risky Bets, Setting Up Its Downfall. (Wall Street Journal)

FTX founder Sam Bankman-Fried was not only a tireless fundraiser from venture capital firms including Paradigm and Sequoia Capital, but also quietly made investments in those same funds, according to two people familiar with the matter. The unusual moves show how entangled Silicon Valley VC firms are in Bankman-Fried’s collapsing crypto empire, which has already forced these firms to mark down the value of their FTX stakes—previously worth hundreds of millions of dollars—to zero. (The Information)

FTX collapse has echoes of Lehman. If Tuesday was crypto's Bear Stearns moment — the day that a central player in a financial ecosystem collapsed into the arms of a much bigger rival — then Wednesday was its Lehman Brothers moment, with that same central player simply imploding into a balance-sheet hole of unknowable size. (Axios)

Technology

After Big Tech’s layoff massacre, is the 'cushy tech job' over? Silicon Valley is reeling. In just over a week, over 17,000 workers have been laid off from Twitter, Meta, Salesforce, Coinbase, Stripe, Lyft — the list goes on. For years, Big Tech has been paying high salaries and supplying generous perks to pick up as much talent as it could while retaining even workers who were underperforming. Now, companies are buckling under that rapid growth, making deep cuts, and turning up the heat on performance. (Protocol)

Meta job cuts provide a post-pandemic reality check: ‘The bubble has burst’. Mark Zuckerberg bows to investor demands over spending on metaverse as Big Tech groups halt expansion. (Financial Times)

Gen Z Employees See Digital Tools as a Way to Win at the Office: New research from King’s College London showed that 40% of 16 to 24-year-olds with a workplace in the UK capital find it easier to volunteer for key tasks and ask questions when working remotely. Conversely, their older peers are more inclined to see working from home as a barrier to learning and networking. (Bloomberg)

Cameo lays off staff for second time this year. Cameo conducted another round of layoffs, cutting 80 roles in the second round of job cuts the celebrity video shoutout service has made this year. “Cameo has made the difficult decision to reduce the size of our team in order to adjust to the worsening macroeconomic environment,” Cameo CEO and co-founder Steven Galanis wrote in a memo. (The Information)

Elon Musk laid out his most comprehensive overview for Twitter’s business since he took control of the company less than two weeks ago. In a gathering on Spaces, Twitter’s live audio feature, Mr. Musk spent an hour on Wednesday morning talking about his plans for the social media service, positioning it as a competitor to more than just classic social networks like Facebook. The world’s richest man said Twitter would make money from content creators and delve deeper into video, business segments that TikTok has mastered. He discussed a vision for Twitter to process payments, complete with connected debit cards and bank accounts, which echoed PayPal, the digital payments company he helped found. Mr. Musk has said that he ultimately hopes to transform Twitter into an “everything app” modeled after WeChat, a Chinese social media platform that is used by more than a billion people to find news, hail cabs and order food. (New York Times)

Musk’s first email to Twitter staff ends remote work. He said then that he’s against remote work and would only grant exceptions on a case-by-case basis, as he’s doing now. (Bloomberg)

According to messages shared in Twitter Slack, Twitter’s CISO, chief privacy office, and chief compliance officer all resigned last night. An employee says it will be up to engineers to “self-certify compliance with FTC requirements and other laws.” (Casey Newton)

Smart Links

Piece of Challenger Space Shuttle Found by Documentary Crew Off Florida Coast. (Wall Street Journal)

Goldman Sachs CEO says he expects a ‘reopening’ in capital markets next year. (CNBC)

Larry Summers compares the surge of pain in tech to the dot-com bubble. (The Information)

10 ways colleges can diversify after affirmative action. (The Chronicle of Higher Education)

This child was treated for a rare genetic disease while still in the womb. (ScienceNews)

Meta’s Layoffs Hit Instagram, Facebook and Reality Labs—WhatsApp Less Affected. (The Information)

‘Gentle’ islet cell transplant cures mice of diabetes with few side effects, Stanford Medicine researchers say. (Stanford Medicine)

Octopuses caught on camera throwing things at each other. (Nature)

Good News

Oklahoma City Zoo welcomed its first lion cubs in 15 years. You can help name them (NPR)

Doggy showers help these mudrooms live up to their name. (Washington Post)

Thank you for subscribing to my newsletter. See you Sunday!