Headliners:

Please forward. Sending this to 5 people you think would like it is the best way to help me get the word out. Thank you.

Please sign up for a paid subscription. During this two-week trial, you get the Founding Member Rate — 50% off the regular cost. Continued thanks to everyone who already has done so!

Reminder: Register here for my live online event, this Thursday, April 23 @ 7:30 pm ET: Front Row at the Trump Show: A Conversation with ABC News’ Jonathan Karl.

The World

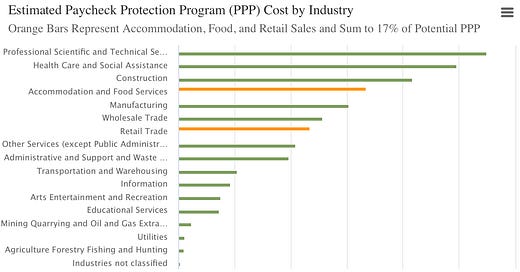

The Senate passed the $484 billion bill by a voice vote, sending it to the House for an approval expected Thursday.President Trump said he supported the legislation. But there are already signs that the $310 billion set aside for the Paycheck Protection Program still might not be enough to meet surging demand for the loans. (Wall Street Journal, Washington Post, Politico)

PNC Bank has told customers that there might not be enough capacity in the program to fund all loan requests.

Banking industry representatives say the program has a burn rate of $50 billion per day and needs closer to $1 trillion to meet demand, with hundreds of thousands of applications pending.

Senate Majority Leader Mitch McConnell made clear that the full Senate must be in session before Congress begins its fifth installment of responding to the pandemic. He signaled he is growing weary of quickly shoveling billions of dollars out the door even as the economy continues to crater. (Politico)

From the Becker Friedman Institution, University of Chicago:

United States intelligence agencies have assessed that Chinese agents spread messages that sowed virus panic in U.S. The American officials were alarmed by fake text messages and social media posts that said President Trump was locking down the country and see a convergence with Russian tactics. (New York Times)

American warships have sailed into disputed waters in the South China Sea, according to military analysts, heightening a standoff in the waterway and sharpening the rivalry between the United States and China. (New York Times)

President Trump said that he has ordered the Navy to “shoot down and destroy” any Iranian gunboats that harass U.S. ships, a directive that comes a week after the Navy reported a group of Iranian boats made “dangerous and harassing approaches” to American vessels in the Persian Gulf. (Associated Press)

A historic crash in crude prices is driving U.S. shale into full-on retreat with operators halting new drilling and shutting in old wells, moves that could cut output by 20% for the world’s biggest producer of oil and leave thousands of workers unemployed. For shale companies, negative prices are the “last nail in the coffin,” while the number of new wells being brought online is forecast to plunge almost 90% by the end of the year. It’s a swift and brutal end to the shale revolution. (Bloomberg)

International oil prices rebound following Trump warning: Brent bounces back from two-decade low after US president takes aim at Iranian vessels. Oil jumped more than 20% on Wednesday, reversing steep losses after a volatile overnight trading session which saw international benchmark Brent crude fall to its lowest level in more than 20 years. (Financial Times, CNBC)

Oilfield firm Baker Hughes Co on Wednesday reported a $10 billion first-quarter loss and revenue fell more than expected as an 80% plunge in oil prices crushed demand for services and equipment. (Reuters)

China is falling behind in its promise to spend $52.4 billion buying U.S. energy over two years -- even as it is filling its storage tanks with Russian and Saudi crude -- independent oil producers warned the Trump administration Tuesday. The American Exploration and Production Council urged the administration in a letter to U.S. Trade Representative Robert Lighthizer to get tough with China. (Bloomberg)

“China has only purchased a de minimis amount of U.S. crude in the first months of 2020, while it has increased purchases of crude oil from Saudi Arabia and Russia,” council chief executive Anne Bradbury said. “Rather than increasing imports from countries like Russia and Saudi Arabia, the Chinese government must take the necessary steps to remain in good standing with the U.S. as a trusted trade partner.”

Missouri sues China for 'not doing enough' to stop coronavirus spread (The Guardian)

The constitutional crisis engulfing Hong Kong expanded significantly Tuesday as the Chinese government voiced its support for the seizure of more than a dozen pro-democracy activists and asserted Beijing’s “rights and responsibilities to maintain the constitutional order” in the city. The move created further doubt about the credibility of the Hong Kong mini-constitution that ostensibly guarantees the city a high degree of autonomy from Chinese interference until 2047, half a century after its handover to China from British rule. (Washington Post)

Major U.S. business lobbying groups are asking Congress to pass measures that would protect companies large and small from coronavirus-related lawsuits when states start to lift pandemic restrictions and businesses begin to reopen. The U.S. Chamber of Commerce, National Association of Manufacturers (NAM) and National Federation of Independent Business (NFIB) are seeking temporary, legal and regulatory safe harbor legislation to curb liabilities for employers who follow official health and safety guidelines. The Business Roundtable, which represents corporate chief executives, is also exploring ways to limit coronavirus liabilities. (Reuters)

A network of right-leaning individuals and groups, aided by nimble online outfits, has helped incubate the fervor erupting in state capitals across the country. The activism is often organic and the frustration deeply felt, but it is also being amplified, and in some cases coordinated, by longtime conservative activists, whose robust operations were initially set up with help from Republican megadonors. (Washington Post)

U.K. Parliament votes to continue democracy by Zoom. Said House of Commons Leader Jacob Rees-Mogg, an old-school Conservative and Victorian scholar: “In 1349, when the Black Death affected this country, Parliament couldn’t sit and didn’t. The session was canceled,” he said. “Thanks to modern technology, even I have moved on from 1349 and am glad to say that we can sit to carry out these fundamental constitutional functions. And I am enormously grateful to many who are as traditionalist as I am who have accepted these constraints.” (Washington Post)

Meanwhile, 'Something's going wrong,' as the UK virus response comes under fire. (Reuters)

The U.S. market for coronavirus antibody testing may open up a multibillion dollar opportunity for Abbott, Roche and other players to vie for, Cowen analysts estimated in a report released Tuesday. With tests typically priced between $5 and $25, the roughly 8.7 million people employed as healthcare practitioners could equate to a $65 million market, not including possible repeat testing over time, the Cowen analysts said. Likewise, the population of more than 70 million students could be an about $500 million market. Even more broadly, if the total U.S. workforce of nearly 160 million people were to be screened, the opportunity could be worth $1.2 billion. (HealthcareDive)

Coronavirus patients taking hydroxychloroquine were no less likely to need mechanical ventilation and had higher deaths rates compared to those who did not take the drug, according to a study of hundreds of patients at US Veterans Health Administration medical centers. The study was posted Tuesday on medrxiv.org, a pre-print server, meaning it was not peer reviewed or published in a medical journal. (CNN)

Universities:

The University of Michigan forecasts losses of up to $1 billion: UM announced cuts Monday to all three campuses — Ann Arbor, Dearborn and Flint — and Michigan Medicine, include reductions in hours, pay and nonessential expenses. In addition, President Mark Schlissel said there would be hiring and salary freezes, and if the financial situation worsens, even deeper cuts, including layoffs, may be necessary. (Detroit Free Press)

California State University, Fullerton announced it was planning to begin the fall 2020 semester online, making it one of the first colleges to disclose contingency plans for prolonged coronavirus disruptions. (NPR)

More than 40% of college fundraisers in a new survey are not confident they'll make their goals this fiscal year because of the coronavirus pandemic. At liberal arts colleges, nearly half of fundraising professionals aren't sure they'll meet their benchmarks. (EducationDive)

A college admissions dean writes open letter to panicked high school juniors, encouraging them to accept what you can’t change and try to focus on the things that you can — and outlining what not to worry about. (Washington Post)

Finance

Companies:

AT&T warned that the coronavirus crisis is clouding its financial outlook as cash-strapped customers spend less. (Wall Street Journal)

Sales at Kimberly-Clark jumped to slightly more than $5 billion in the recent quarter as consumers stockpiled paper products. (Wall Street Journal)

Delta Air Lines’ on Wednesday posted its first quarterly loss in more than five years and issued a bleak spring forecast as the coronavirus continues to sap travel demand. The airline was burning $100 million a day burning $100 million during the coronavirus travel slump. (CNBC)

Expedia is in advanced talks to sell a stake to private-equity firms Silver Lake and Apollo Global Management after the widespread travel bans caused by the coronavirus pandemic ravaged the online-booking company’s business. The investment is likely to total around $1 billion, the people said. (Wall Street Journal)

Apollo Global Management, Oaktree Capital Management and BGH Capital are among those that have expressed interest in restructuring Virgin Australia Holdings, five sources said. (Reuters)

A new working paper from the National Bureau of Economic Research is the first to use recent data on household transactions, like going out to eat, to investigate how the COVID-19 pandemic has curtailed purchases. The paper shows the sharp drop in consumer spending, which drives the U.S. economy, as the country shut down in March. (Journalist’s Resource)

As the number of cases grew, households began to radically alter their typical spending across a number of major categories. Initially spending increased sharply, particularly in retail, credit card spending and food items. This was followed by a sharp decrease in overall spending. Households responded most strongly in states with shelter-in-place orders in place by March 29th. Greater levels of social distancing are associated with drops in spending, particularly in restaurants and retail. (National Bureau of Economic Research)

Demographic characteristics such as age and family structure provoked larger levels of heterogeneity in spending responses to COVID-19, while income did not. Moreover, users of all political orientation increased spending prior to the epidemic.

Note: The sample isn’t nationally representative — it doesn’t reflect the demographic makeup of the whole country — and participants skew toward people under 30.

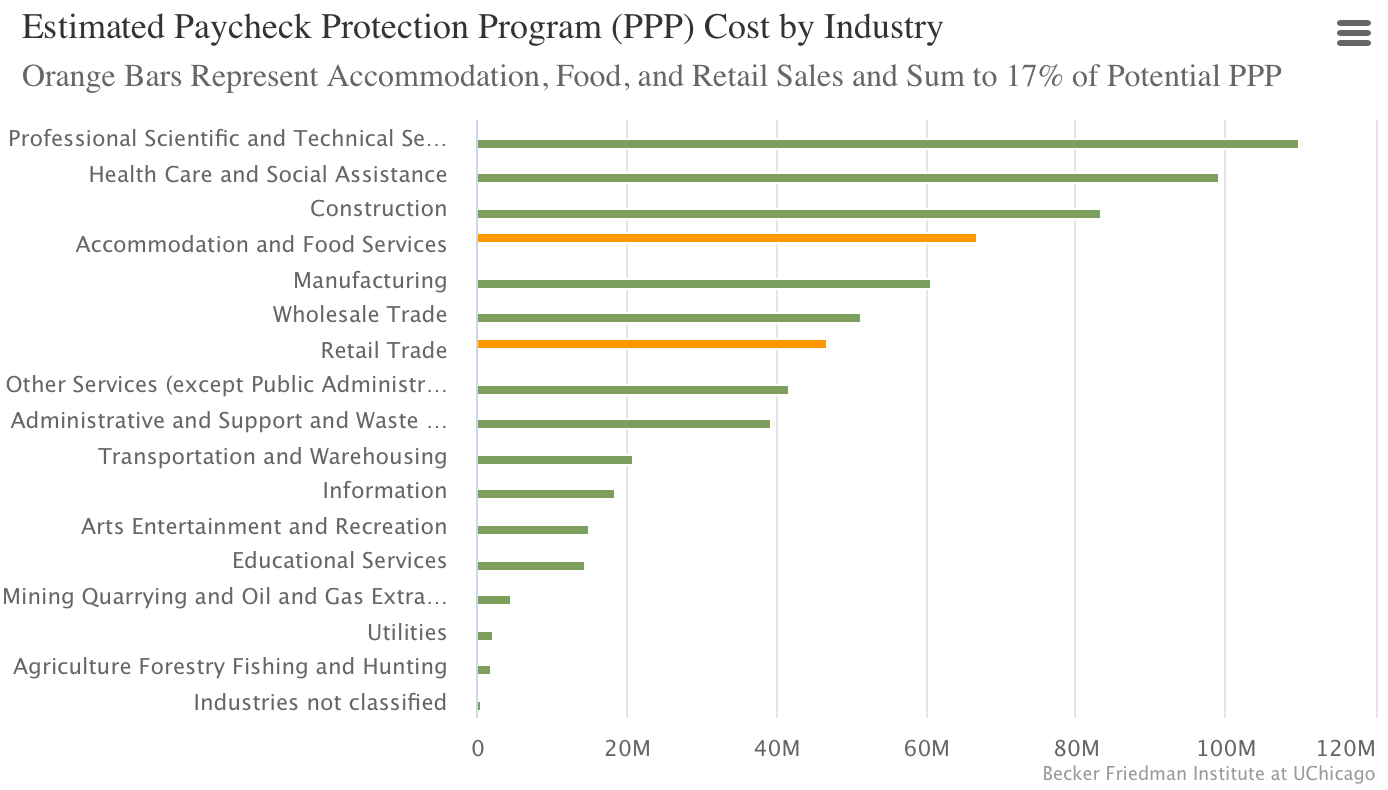

43% of U.S. adults now say that they or someone in their household has lost a job or taken a cut in pay due to the outbreak, up from 33% in the latter half of March. Among lower-income adults, an even higher share (52%) say they or someone in their household has experienced this type of job upheaval. (Pew Research Center)

German shoppers not rushing back as stores reopen: German consumers are counting their pennies rather than returning to shop in large numbers as stores gradually reopen after being locked down during the coronavirus crisis, the national retailers association said on Wednesday. The HDE association said the mood among shoppers remained very subdued due to concerns about jobs and finances. (Reuters)

“Consumers are in a crisis mode, consumer sentiment is in the doldrums,” a spokesman said.

Remittance flows are expected to plunge by more than $100bn. Coronavirus hit to global economy depletes vital source of finance for poor nations. (Financial Times)

Weekly mortgage demand stalls, even with interest rates at a record low. Total mortgage application volume decreased 0.3% last week from the previous week, according to the Mortgage Bankers Association. (CNBC)

Technology

Spending on digital games reached $10.0B in March, the highest monthly total ever. Total digital revenue was up 11% year-over-year from March 2019. (SuperData Research)

Premium console and premium PC earnings jumped as lockdowns took effect. Premium console revenue rose 64% from February to March ($883M to $1.5B) and premium PC revenue rose 56% during the same period ($363M to $567M). These game types tend to be most popular in North America and Europe, where COVID-19 prevention measures expanded dramatically in March.

New data show just how much pandemic quarantines have shrunk the ride-hailing business. (The Information)

Uber’s global gross bookings in recent weeks were running at 80% below year-ago levels.

Lyft saw similar trends, although its business is now down about 75% from last year’s levels.

General Motors is shutting down Maven, a small car-sharing business.

Netflix added 15.8 million subscribers, more than double the 7.2 million that were expected — a growth of more than 22 percent year over year. Netflix now has 182 million subscribers worldwide. The company also saw quarterly revenue of $5.77 billion. (The Verge)

Still, Netflix’s opening letter to shareholders isn’t all good. The letter notes that “some of the lockdown growth will turn out to be pull-forward from the multi-year organic growth trend, resulting in slower growth after the lockdown is lifted country-by-country.” The letter adds that executives expect “viewing to decline and membership growth to decelerate as home confinement ends, which we hope is soon.”

Meanwhile, Netflix is selling some $1 billion in new junk bonds to fund content acquisitions and production, among other general corporate purposes. (Bloomberg)

With Facebook buying a 9.99% stake in Jio Platforms, the two giants could be potentially sitting on a goldmine of data. The Mukesh Ambani-owned company is the umbrella entity for all of Reliance Industries’ (RIL) digital and internet businesses. One of the largest investments across the world for a minority stake in the technology sector, this deal puts the spotlight on the huge amount of data each of the platforms generates. (Quartz)

Activist investor ValueAct Capital Partners LP has built a stake of over $1.1 billion in Nintendo, according to a letter seen by Reuters, a bet that digital software distribution and the development of new entertainment products will fuel growth at the Japanese gaming company. ValueAct added that there is potential for growth both in the software business and room for the company to transform itself into a broader entertainment company. (Reuters)

People are making bots to snatch Whole Foods delivery order time slots: Developers are creating a tech divide between those who can use a bot to order their food and those who just have to keep trying during the pandemic. (Vice)

Smart Links

Black-hole collision: An unprecedented signal from unevenly sized objects gives astronomers rare insight into how black holes spin.

“It’s an exceptional event,” said Maya Fishbach, an astrophysicist at the University of Chicago in Illinois. (Nature)

Here's when all 50 states plan to reopen after coronavirus restrictions. (The Hill)

Coronavirus found in Paris sewage points to early warning system. (Science Magazine)

Chipotle Mexican Grill has agreed to pay a record $25 million fine to resolve criminal charges involving food-safety violations. (CNN)

Poisonings related to cleaners and disinfectants surged in the U.S. last month as the global pandemic spurred a haphazard rush to disinfect everything. (Bloomberg, CDC)

Bill and Melinda Gates buy an oceanfront home near San Diego for $43 million. (Wall Street Journal)

Good News

Earth Day

He became one of America’s most famous widowers — thanks to his wife. Now he’s trying to teach us about grief.

The husband from the New York Times Modern Love column with the drop-everything-and-read-this headline “You May Want to Marry My Husband” has written a book: My Wife Said You May Want to Marry Me. (Washington Post)

Thanks for reading. Did you like the newsletter? Why not subscribe now?