Like the newsletter? During this trial period, you get the Founding Member Rate — 50% off the regular cost. Continued thanks to everyone who already has done so!

The World

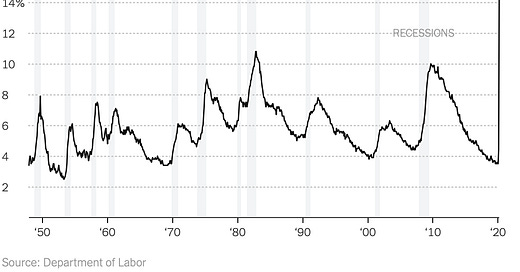

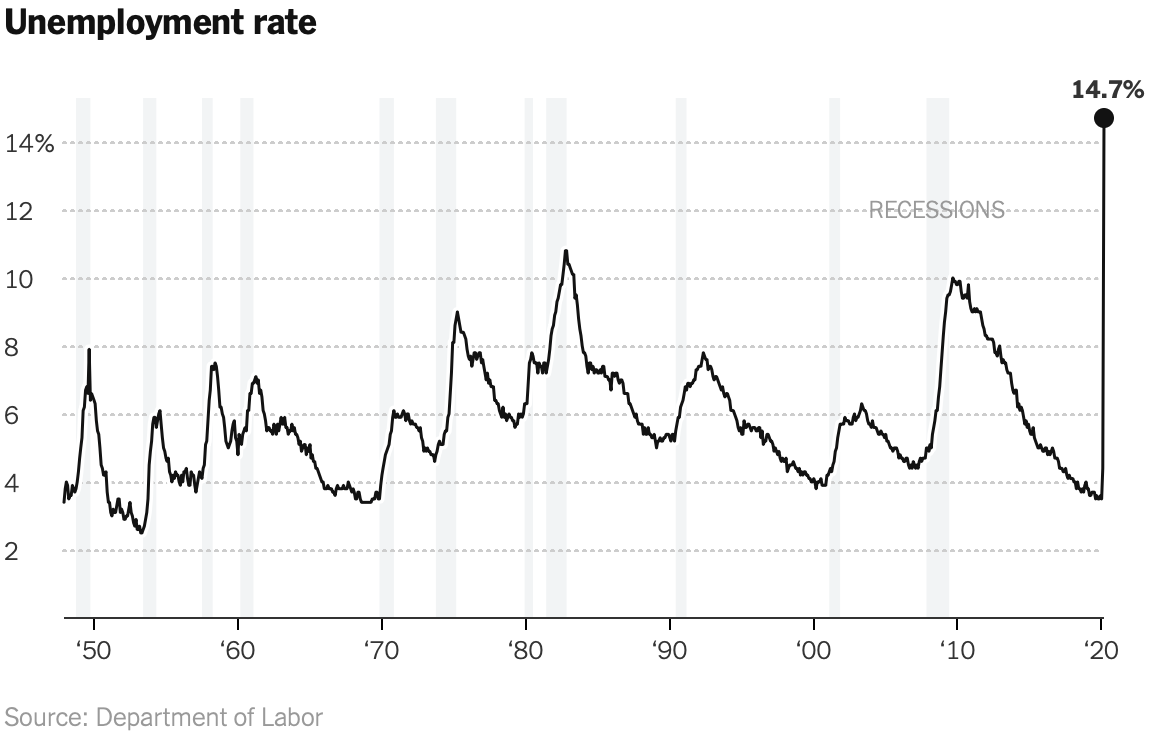

The economy shed more than 20.5 million jobs in April, sending the unemployment rate to 14.7 percent — devastation unseen since the Great Depression. As unemployment skyrockets and states reopen, workers balance health vs. economic risks. (New York Times, Washington Post)

Demand for small-business loans has cooled. More than 40% of the money remains available as business owners worry they won’t get loans forgiven. (Wall Street Journal)

Gen Z workers at small businesses have been hit hardest by layoffs. Workers under the age of 25 have experienced a 93% higher rate of layoffs than those ages 35 and older. Meanwhile, 52 percent of small businesses predict they will close within the next six months. (HR Dive, SHRM)

More than 1,000 workers at the Tyson Foods plant in Waterloo have tested positive for the coronavirus — more than double the number Gov. Kim Reynolds had said were infected the day before. (Des Moines Register)

US-China trade negotiators vowed to save the Phase One Deal on their first call during pandemic. China is not close to meeting U.S. purchase demands, with supply chains disrupted on both sides. (South China Morning Post)

The Bank of England warned that the UK will see its worst recession in 300 years. Meanwhile, Brazil’s Economy Minister said the country could face "economic collapse" in a month's time, with food shortages and "social disorder.” (Financial Times, AFP)

President Trump voiced uncertainty over FBI Director Christopher A. Wray’s future a day after the Justice Department moved to throw out the guilty plea of former National Security Adviser Michael T. Flynn. (Washington Post)

A drop in FAFSA completions suggests students are postponing or abandoning college. (Forbes)

Economy

First, J. Crew. Now Neiman Marcus. Flashing red: J.C. Penney, Hertz and many more. A wave of U.S. bankruptcies builds toward worst run in many years. (Bloomberg)

The two-year Treasury yield settled at a record low, as traders price in the possibility that the Fed will cut its policy rate below zero. (Wall Street Journal)

Mortgage rates are at record lows, but borrowers are running into the toughest loan-approval standards in years. Lenders have implemented higher credit-score and down payment requirements, and in some cases stopped issuing certain types of loans altogether, in effect shutting down a large swath of the market. (Bloomberg)

A third of Americans didn't pay their rent or mortgage in May. (Vice)

Technology

Algorithms are driving the price of some goods out of whack. Dynamic-pricing systems, trained to optimize sales on platforms like Amazon, are sending bags of rice to $60 and peanut butter to $45. (The Markup)

Apple shifts 30% of AirPod production from China to Vietnam to diversify its supply chain. (Nikkei Asian Review)

Google's parent company Alphabet abandoned a controversial plan to build a “smart city” on Toronto’s waterfront blaming “economic uncertainty.” (The Daily Telegraph)

Facebook will allow most employees to work from home through end of 2020. (CNBC)

Smart Links

Students should take a gap year at home. Here’s how. (New York Times)

Why North Dakota has the best internet in the U.S. (Vice)

Telescopes and spacecraft probe deep into Jupiter's atmosphere. (NASA)

Five best science books this week. (Nature)

New Harvard interactive tool measures economic movement in real time. (Harvard Gazette)

Geopolitics and technology threaten America’s financial dominance. (The Economist)

How V-E Day echoed around the world. (New York Times)

Good News

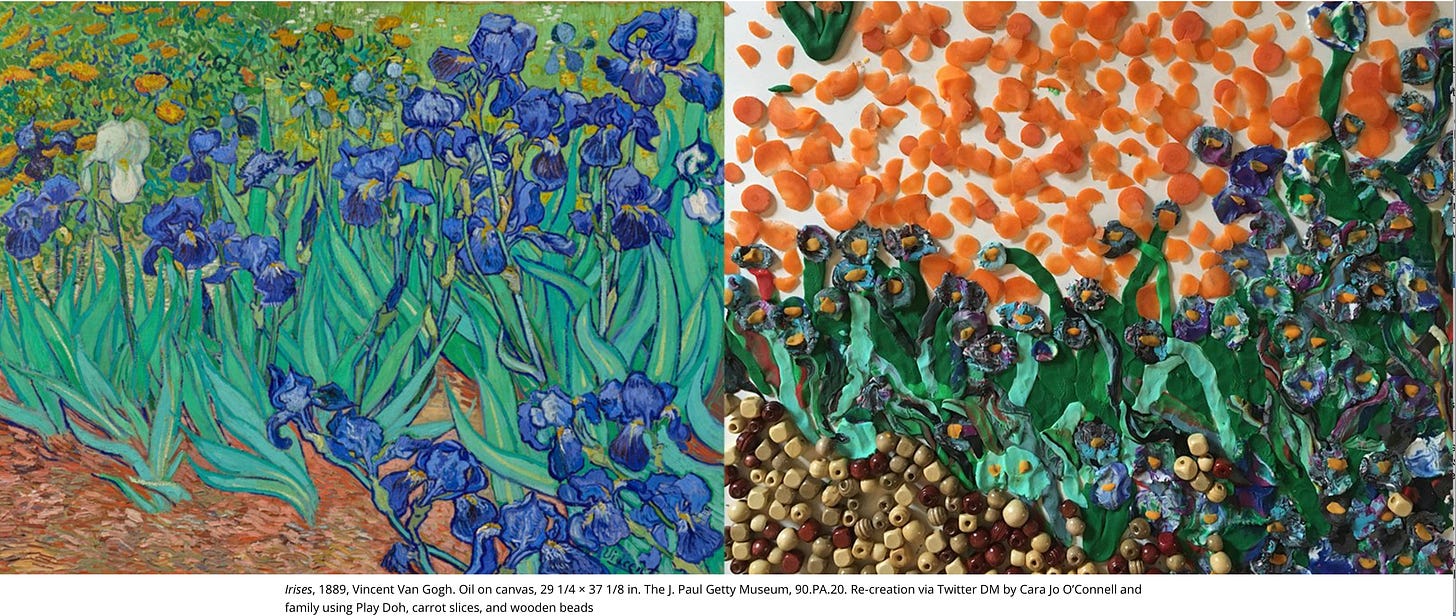

Getty Museum artworks are recreated with household items by creative geniuses the world over. (The Iris)

Bob Dylan is “The Busiest Man In Quarantine.” (Vulture)

Thanks for reading. Did you like the newsletter? Why not subscribe now?